I am old enough to remember when an elevator was typically operated by a real person--the lift man--who rode the car up and down all day and opened and closed the door manually. If you were waiting for an elevator, a soft "ding" would signal that the elevator had just arrived at your floor. Then the door would slide open. Getting on depended on whether the lift man behind the door said "going up" or "going down."

I am old enough to remember when an elevator was typically operated by a real person--the lift man--who rode the car up and down all day and opened and closed the door manually. If you were waiting for an elevator, a soft "ding" would signal that the elevator had just arrived at your floor. Then the door would slide open. Getting on depended on whether the lift man behind the door said "going up" or "going down."Numbers cruncher David Trainer is saying "Going down," and it's not an elevator that he is talking about. It is Bank of America's common stock (ticker symbol: BAC). BAC has had a doozer of a Dow Dog rally, levitating by 60% since the December doldrums. The stock has spent most of February flatlining at $8 a share. As explained here, Trainer expects a return trip to $5, and maybe all the way to the basement. He is telling investors to get off now.

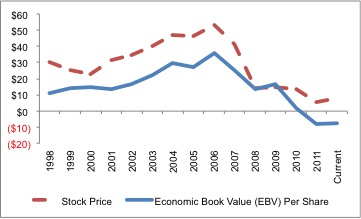

Trainer has developed a construct called economic book value (EBV), "which measures the equity value of the business based on its actual operating cash flow after tax net of all liabilities," including off-balance-sheet debt, pensions, preferred stock, and outstanding stock options. He considers EBV a more useful indicator than reported earnings, which are massively massaged by clever accountants. According to Trainer, Bank of America's EBV is negative (and, you guessed it, going down).

Last we checked, the MainePERS portfolio was holding steady at 2.6 million shares of BAC and seemingly intent on checking out the basement. BAC used to be a top-ten holding, but no more, thanks to the erosion in share price. Now appearing in the Top Ten (as of 12-31-11) are Johnson & Johnson and Pfizer, amounting to $90 million worth of high-priced pharmaceuticals. Once considered among the bluest of blue chips, Big Pharma stocks will soon be subjected to earnings risks of their own. According to Casey Research, several blockbuster drugs are coming off patent in 2012. Combined, these babies add up to $35 billion in annual sales. New competition from generics will certainly eat into those revenues. 58% of J & J's revenues will be at risk, 66% of Pfizer's. MainePERS portfolio managers are reaching for Tums as we speak.

Back to Bank of America. Not only is the company going down; it is leaving town altogether. Mainers found that out Monday when BofA announced that it was closing a call center in Orono and shedding as many as 200 employees. The company may be shedding customers as well. The Wall Street Journal this morning reports that BofA is contemplating new service fees for basic checking accounts. Must do something about that negative EBV.

[update, 03-05-12--]

John Hussman's weekly commentary highlights the biggest reason not to own bank stocks:

"A good amount of bad debt has been written down, but the remaining bad debt still needs restructuring. Notably, non-current assets and bank-owned non-foreclosed property ("other real estate owned" or OREO) is actually a larger percentage of bank assets today than in 2008. Restructuring generally means reducing the interest spread or writing down a portion of the principal, and this process is likely to siphon off earnings in the financial sector for years. Despite their preferred status as 'risk on' speculative assets, I continue to view financials as a minefield."

No comments:

Post a Comment